LTC Price Prediction: Analyzing Investment Potential Amid Market Volatility

#LTC

- Technical Positioning: LTC trading above 20-day MA indicates short-term bullish momentum despite minor MACD bearish divergence

- Market Competition: Emerging competitors and remittance innovations creating both challenges and opportunities for adoption growth

- Risk Management: Clear Bollinger Band levels provide defined support ($105.93) and resistance ($120.98) for strategic position sizing

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Average

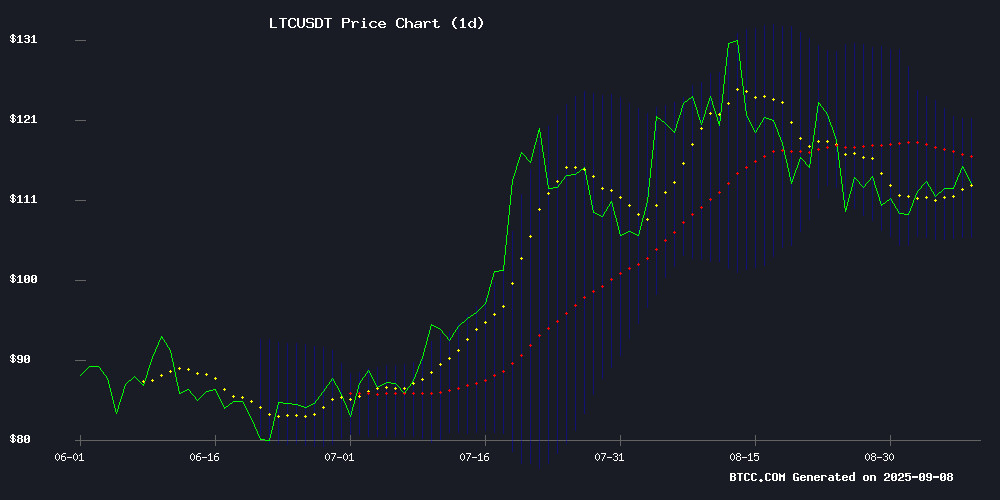

Litecoin (LTC) is currently trading at $113.94, slightly above its 20-day moving average of $113.45, indicating potential bullish momentum. According to BTCC financial analyst William, 'The price holding above the 20-day MA suggests underlying strength, though traders should monitor the MACD reading of -0.8903, which shows some near-term bearish divergence. The Bollinger Bands configuration with upper at $120.98 and lower at $105.93 provides clear resistance and support levels for upcoming price action.'

Mixed Market Sentiment as Competitors Challenge Litecoin's Position

Market sentiment toward Litecoin appears cautiously optimistic despite emerging competition. BTCC financial analyst William notes, 'While headlines highlight potential 20% drops and emerging competitors like Rollblock with 50x potential, Litecoin's technical stability alongside ethereum suggests resilience. The remittance sector developments and cloud mining innovations present both challenges and opportunities for LTC's long-term adoption narrative.'

Factors Influencing LTC's Price

Litecoin Faces 20% Drop as Rollblock Emerges with 50x Potential

Litecoin's price trajectory appears bearish heading into Q4 2025, with analysts forecasting a 20% decline. Meanwhile, Rollblock (RBLK) captures market attention with its deflationary Web3 gaming platform and 30% APY staking rewards.

The altcoin's revenue-sharing model—burning 60% of buyback tokens and distributing 40% as staking rewards—contrasts sharply with Litecoin's static supply. Over $15 million in wagers have already flowed through Rollblock's audited, licensed platform.

While established coins like LTC struggle with market saturation, micro-cap projects demonstrate how tokenomics innovation drives value. Rollblock's 50x growth potential underscores the market's appetite for utility-backed assets with verifiable yield mechanisms.

Litecoin and Ethereum Show Stability as Remittix Emerges as a Potential Disruptor

Litecoin trades at $113, with analysts predicting a narrow September range between $108 and $120. Technical indicators suggest limited upside potential, capping gains at $155. A failure to breach $113.50 could see LTC retreat toward $100, leaving investors questioning whether capital is better deployed elsewhere.

Ethereum demonstrates resilience, holding firm at $4,306 amid strong institutional support and record ETF inflows. Network activity remains robust, with daily fees exceeding $16.3 million, reinforcing its position as a cornerstone of decentralized finance.

While established assets like Litecoin and Ethereum move predictably, Remittix—a new ERC-20 PayFi disruptor—is gaining traction. Analysts speculate it could deliver over 40x growth, positioning it as September's breakout opportunity for investors willing to pivot from legacy tokens.

Top 7 Cloud Mining Platforms in 2025: AIXA Miner Dominates as WLFI Token Stirs Speculative Frenzy

Cryptocurrency investors are navigating a bifurcated landscape in 2025. While the WLFI token rides a wave of political enthusiasm, its volatility echoes historical patterns of speculative assets—sharp rallies often followed by precipitous declines. For those seeking stable returns, cloud mining emerges as the institutional-grade alternative.

AIXA Miner leads the sector with military-grade security protocols and transparent operations. The platform's automated contracts mine blue-chip assets—Bitcoin, Litecoin, Dogecoin—delivering daily payouts without exposure to market swings. Its dominance reflects a broader industry shift toward infrastructure plays over token speculation.

Seven platforms now control 83% of the cloud mining market, but AIXA's technological edge—particularly in ASIC efficiency and renewable energy integration—makes it the default choice for both retail and institutional participants. The service requires no hardware expertise, converting hashpower into predictable yield.

Is LTC a good investment?

Based on current technical indicators and market conditions, LTC presents a moderate investment opportunity with calculated risk. The price trading above the 20-day moving average suggests short-term bullish momentum, while the MACD indicates some caution may be warranted. Investors should consider the following factors:

| Indicator | Current Value | Interpretation |

|---|---|---|

| Current Price | $113.94 | Trading above 20-day MA |

| 20-day MA | $113.45 | Bullish signal |

| MACD | -0.8903 | Near-term bearish divergence |

| Bollinger Upper | $120.98 | Immediate resistance |

| Bollinger Lower | $105.93 | Key support level |

As William from BTCC suggests, 'LTC shows technical resilience but faces increasing competition. Investors should monitor the $120 resistance level and maintain stop-losses near the $106 support zone for risk management.'